Submitted by Mike krieger via Liberty Blitzkrieg blog,

This spring, traders and analysts working deep in the global swaps markets began picking up peculiar readings: Hundreds of billions of dollars of trades by U.S. banks had seemingly vanished.

The vanishing of the trades was little noted outside a circle of specialists. But the implications were big. The missing transactions reflected an effort by some of the largest U.S. banks — including Goldman Sachs, JP Morgan Chase, Citigroup, Bank of America, and Morgan Stanley — to get around new regulations on derivatives enacted in the wake of the financial crisis, say current and former financial regulators.

The trades hadn’t really disappeared. Instead, the major banks had tweaked a few key words in swaps contracts and shifted some other trades to affiliates in London, where regulations are far more lenient. Those affiliates remain largely outside the jurisdiction of U.S. regulators, thanks to a loophole in swaps rules that banks successfully won from the Commodity Futures Trading Commission in 2013.

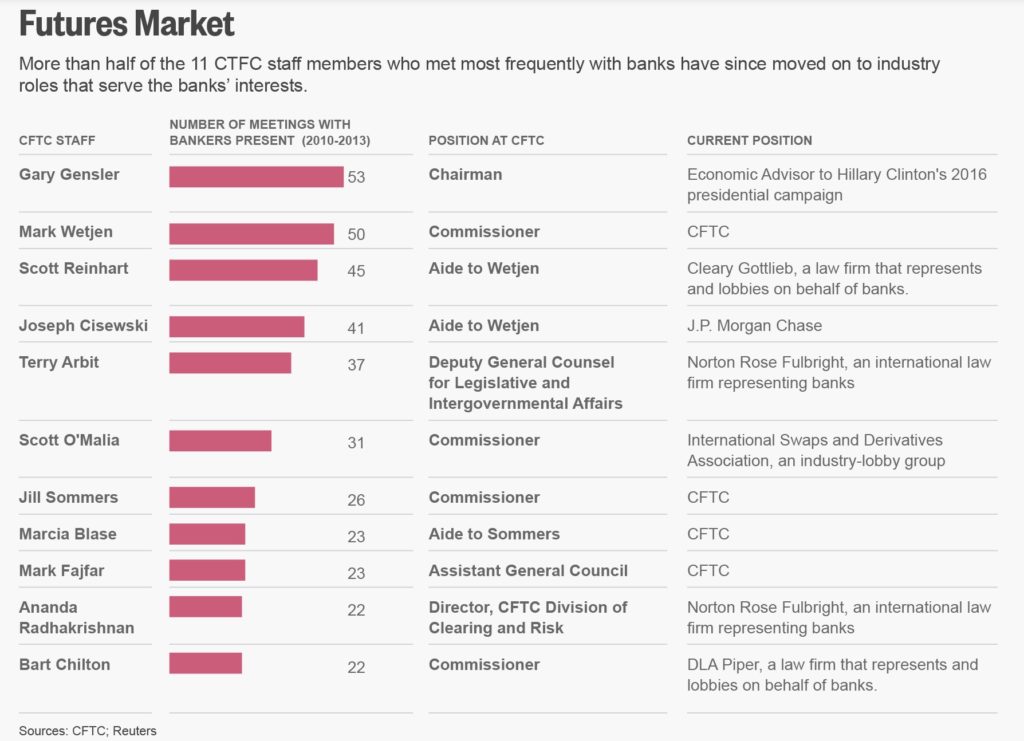

Many of the CFTC employees who were lobbied in these meetings went on to work for banks. Between 2010 and 2013, there were 50 CFTC staffers who met with the top five U.S. banks 10 or more times. Of those 50 staffers, at least 25 now work for the big five or other top swaps-dealing banks, or for law firms and lobbyists representing these banks.

The lobbying blitz helped win a ruling from the CFTC that left U.S. banks’ overseas operations largely outside the jurisdiction of U.S. regulators. After that rule passed, U.S. banks simply shipped more trades overseas. By December of 2014, certain U.S. swaps markets had seen 95 percent of their trading volume disappear in less than two years.

– From the excellent Reuters article: U.S. Banks Moved Billions of Dollars in Trades Beyond Washington’s Reach

The following story is guaranteed to make you sick. Once again, we’re shown that following trillions in taxpayer funded bailouts and backstops, TBTF Wall Street banks immediately went ahead and focused all their attention obtaining loopholes in order to transfer risk and make billions upon billions of dollars in the financial matrix, as opposed to adding any benefit whatsoever to society.

From Reuters:

NEW YORK – This spring, traders and analysts working deep in the global swaps markets began picking up peculiar readings: Hundreds of billions of dollars of trades by U.S. banks had seemingly vanished.“Kenneth Raisler, a former Enron lobbyist representing JP Morgan, Citigroup, and Bank of America.”

“We saw strange things in the data,” said Chris Barnes, a former swaps trader now with ClarusFT, a London-based data firm.

The vanishing of the trades was little noted outside a circle of specialists. But the implications were big. The missing transactions reflected an effort by some of the largest U.S. banks — including Goldman Sachs, JP Morgan Chase, Citigroup, Bank of America, and Morgan Stanley — to get around new regulations on derivatives enacted in the wake of the financial crisis, say current and former financial regulators.

The trades hadn’t really disappeared. Instead, the major banks had tweaked a few key words in swaps contracts and shifted some other trades to affiliates in London, where regulations are far more lenient. Those affiliates remain largely outside the jurisdiction of U.S. regulators, thanks to a loophole in swaps rules that banks successfully won from the Commodity Futures Trading Commission in 2013.

For large investors, the products are an important tool to hedge risk. But in times of crisis, they can turn toxic. In 2008, some of these instruments helped topple major financial institutions, crashing the U.S. economy and leading to government bailouts.

After the crisis, Congress and regulators sought to rein in this risk, and the banks fought back. From 2010 to 2013, when the CFTC was drafting new rules, representatives of the five largest U.S. banks met with the regulator more than 300 times, according to CFTC records. Goldman Sachs attended at least 160 of those meetings.

Many of the CFTC employees who were lobbied in these meetings went on to work for banks. Between 2010 and 2013, there were 50 CFTC staffers who met with the top five U.S. banks 10 or more times. Of those 50 staffers, at least 25 now work for the big five or other top swaps-dealing banks, or for law firms and lobbyists representing these banks.

The lobbying blitz helped win a ruling from the CFTC that left U.S. banks’ overseas operations largely outside the jurisdiction of U.S. regulators. After that rule passed, U.S. banks simply shipped more trades overseas. By December of 2014, certain U.S. swaps markets had seen 95 percent of their trading volume disappear in less than two years.

While many swaps trades are now booked abroad, some people in the markets believe the risk remains firmly on U.S. shores. They say the big American banks are still on the hook for swaps they’re parking offshore with subsidiaries.

Still, the banks’ victory on the swaps loophole leaves a concentrated knot of risk at the heart of the financial system. The U.S. derivatives market has shrunk but remains large, with outstanding contracts worth $220 trillion at face value. And the top five top banks account for 92 percent of that.

In 2009, President Barack Obama tapped Gary Gensler, then 51 years old, to chair the CFTC. Liberals grumbled about Gensler’s résumé. The son of a cigarette and pinball-machine salesman in working class Baltimore, Gensler, at 30, had become the youngest banker ever to make partner at Goldman Sachs.

Among other jobs, he oversaw the bank’s derivatives trading in Asia. Later, as an undersecretary of the Treasury, Gensler helped push through the 2000 law that had banned regulation of derivatives markets.

Kenneth Raisler, a former Enron lobbyist representing JP Morgan, Citigroup, and Bank of America, argued in a letter that the CFTC should allow U.S. banks to do things overseas “even if those activities were not permissible for a U.S. bank domestically.”

You just can’t make this stuff up. Gold Jerry, gold.

Meanwhile, Obama was hard at work as always proving himself to be a capable banker coddler in order to ensure his payday upon leaving office.

In his place, Obama nominated a long time aide to Democratic Senator Harry Reid, Mark Wetjen. Gensler and other pro-reform allies assumed that the veteran Democrat would vote with the Democrats on the commission.Perhaps I should ask John Hilsenrath whether it is “anti-Semitic” to point this out.

Wetjen, a derivatives newcomer, was not a conventional liberal. He came with an endorsement from the U.S. Chamber of Commerce, an opponent of the Dodd-Frank Act. As his policy adviser, Wetjen hired Scott Reinhart, former in-house counsel at the structured credit products division at Lehman Brothers – the bank whose collapse in 2008 set off the financial crisis.

Rosen, the banks’ lead lawyer, discussed Wetjen often on calls with his bank clients. The newcomer, Rosen told them, was key to swinging the commission in the banks’ favor.

Banks got dramatically more face time with commissioners after Wetjen’s appointment. In 2010, Gensler had met with the top five U.S. banks 13 times, and in 2011, 10 times. That was still more than any other staffer or commissioner at the CFTC.

In the year after Wetjen’s appointment, Wetjen aide Reinhart met with the top five banks 36 times, more than anyone else at the CFTC. Wetjen himself met with the top banks second-most often, 34 times. Gensler met them less than half as frequently, as did nearly every other commissioner and staffer, according to the records.

In June, Reinhart left the CFTC to join Rosen’s practice at Cleary Gottlieb.

Gensler had little patience for the bank-friendly Wetjen, former CFTC officials say. As their disagreements sharpened, Wetjen’s pro-bank views seemed to harden, these people said.

“Mark was struggling a little with the substance,” one former CFTC official said. “Gary treated Mark like he was a moron, and then Mark refused to budge.”

“The fight over this provision was one of the biggest policy fights in all of Dodd Frank,” said Kelleher, of the think tank Better Markets. “Once the banks got that loophole, then a lot of that predatory behavior migrated overseas to wherever there was less regulation.”

Goldman had already started moving to restructure its trading operations to get around Dodd-Frank. In March 2012, it sent out a four-page letter to its derivatives clients with an unusual demand. Goldman wanted clients to sign off on giving the bank standing permission to move a client’s swaps trades to different affiliates around the world, whenever and wherever the bank saw fit.

Goldman called the letter the “Multi-entity ISDA Master Agreement.” It meant that a client might strike a derivatives deal with Goldman in New York in the morning, and that afternoon, with no disclosure, a Goldman office in London or Singapore or Hong Kong could take over the deal. With each shift, the trade could fall under different regulators.

Just in case you need a reminder of how incredibly putrid and corrupt Banana Republic America has become…

The global inter-dealer market for interest rate swaps in Euros is one of the largest derivatives markets in the world. U.S. banks’ monthly share of the market had plunged nearly 90 percent since January 2013, from over $1 trillion to $125 billion, according to ISDA.Where have you heard about the Securities Industry and Financial Markets Association, or SIFMA, before? Recall the following from the post, Ex-NSA Chief Keith Alexander is Now Pimping Advice to Wall Street Banks for $1 Million a Month:

The data were misleading. U.S. banks were still trading as vigorously as ever. But their trades, booked through London affiliates, without any credit guarantees linking them back to the U.S., were now showing up in the data as the work of European banks.

In mid 2014, the Securities Industry and Financial Markets Association, a banking lobby in Washington, circulated a private memo to its members. The memo consisted of talking points banks could use to justify the de-guaranteed contracts and shifting of trades if questioned by regulators and lawmakers.

So what is Mr. Alexander charging for his expertise? He’s looking for $1 million per month. Yes, you read that right. That’s the rate that his firm, IronNet Cybersecurity Inc., pitched to Wall Street’s largest lobbying group the Securities Industry and Financial Markets Association (SIFMA), which ultimately negotiated it down to a mere $600,000 a month. In case you need a refresher on how much of a slimy character this guy is, I suggest you read the following posts…What would we have done without the bailouts…

0 comments:

Post a Comment