Submitted by Tyler Durden on 04/13/2016 08:01 -0400

http://www.zerohedge.com/news/2016-04-12/it-begins-obama-forgives-student-debt-400000-americans

Joining the ranks of "broke lawyers" who can cancel their student debt, "Americans with disabilities have a right to student loan relief,” now according to Ted Mitchell, the undersecretary of education, said in a statement. Almost 400,000 student loan borrowers will now have an easier path to a debt bailout as Obama primes the populist voting pump just in time for the elections.

On top of "the student loan bubble’s dirty little secret," here is another round of student debt relief...as MarketWatch reports,

The Department of Education will send letters to 387,000 people they’ve identified as being eligible for a total and permanent disability discharge, a designation that allows federal student loan borrowers who can’t work because of a disability to have their loans forgiven. The borrowers identified by the Department won’t have to go through the typical application process for receiving a disability discharge, which requires sending in documented proof of their disability. Instead, the borrower will simply have to sign and return the completed application enclosed in the letter.* * *

If every borrower identified by the Department decides to have his or her debt forgiven, the government will end up discharging more than $7.7 billion in debt, according to the Department.

“Americans with disabilities have a right to student loan relief,” Ted Mitchell, the undersecretary of education, said in a statement. “And we need to make it easier, not harder, for them to receive the benefits they are due.”

About 179,000 of the borrowers identified by the Department are in default on their student loans, and of that group more than 100,000 are at risk of having their tax refunds or Social Security checks garnished to pay off the debt. Often borrowers losing out on these benefits aren’t even aware that they’re eligible for a disability discharge, said Persis Yu, the director of the Student Loan Borrower Assistance Project at the National Consumer Law Center.

“Borrowers just frankly don’t know about this program,” she said. “In the past it’s been incredibly complicated to apply and that process has been getting better over time, but some people just assume that it’s not going to work.” The letters will help make more borrowers aware of their rights, Yu said.

So it's a start - "broke lawyers" , "the poor" and "disabled Americans" get student debt relief. What about models that suddenly become too ugly to work? Or Petroleum Engineers no longer able to work because of The Fed's over-indulgent easy money creating a glut in oil prices? Don't they have a right to relief from their student debt? Seems like not granting students debt relief would violate all of their "safe spaces" - so cancel it all! Student Debt Jubilee here we come.

As we detailed previously, however, this is a drop in the bucket...

Borrowers hold $1.2 trillion in federal student loans, the second-biggest category of consumer debt, after mortgages. Of that, more than $200 billion is in plans with an income-based repayment option, according to the Department of Education and Moody’s Investors Service. For taxpayers the loans are "a slow-ticking time bomb," says Stephen Stanley, a former Federal Reserve economist who’s now chief economist at Amherst Pierpont Securities in Stamford, Conn.So that's a $39 billion taxpayer loss just on loans originated this year or later, and that could very well rise as schools begin to figure out that they can effectively charge whatever they want for tuition now that the government is set to pick up the tab for any balances borrowers can't pay (which incidentally is precisely what we said in March).

The Congressional Budget Office estimates that, for loans originated in 2015 or after, the programs will cost the government an additional $39 billion over the next decade.

Consider that, then consider how much of the existing $200 billion pile of IBR debt will have to be written off and add in another $10 billion or so to account for for-profit closures and it's not at all unreasonable to suspect that taxpayers will ultimately get stuck with a bill on the order of $100 billion by the time it's all said and done and that's if they're lucky - if the "cancel all student debt" crowd gets its way, the bill will run into the trillions.

* * *

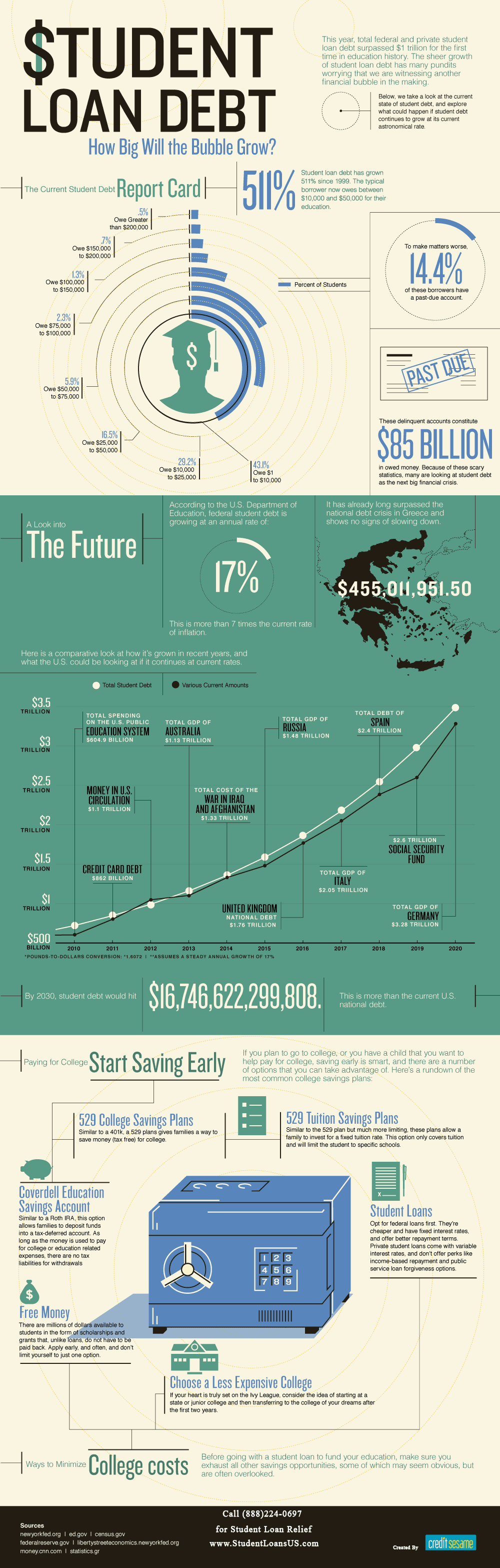

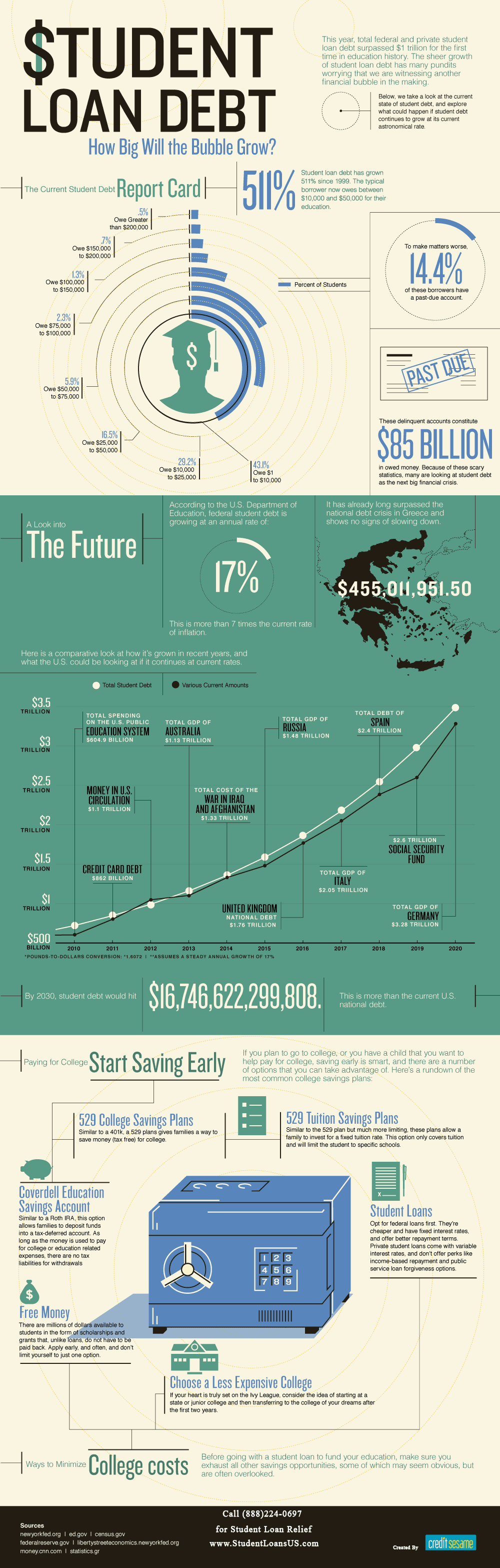

And finally, as a reminder, if things don't change, Student Debt could be $17 trillion by 2030...

Student Loan Debt is a cancer for our society. This

misconception that getting a college education equals a steady career

has been dashed by the recession. For-profit colleges pray on

undereducated and low-income individuals. Text book prices have risen

exponentially while the cost of a quality education has as well.

Source: DailyInfographic.com

This industry of education is going backwards, and will one day burst.

Source: DailyInfographic.com

This industry of education is going backwards, and will one day burst.

0 comments:

Post a Comment