Submitted by Tyler Durden on 04/19/2016 19:30 -0400

http://www.zerohedge.com/news/2016-04-19/what-everyone-missing-oil-supplydemand-conundrum

Submitted by Gail Tverberg via Our Finite World blog,

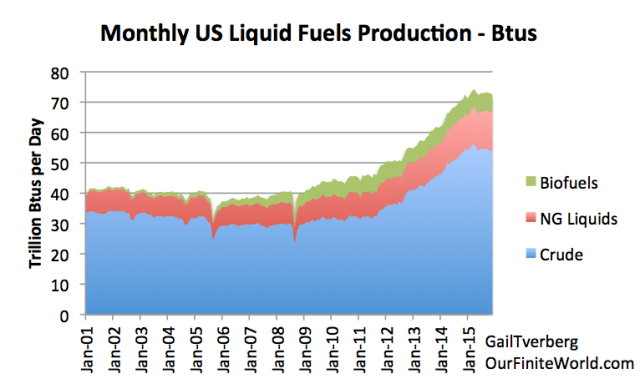

Oil production can be confusing because there are various “pieces” that may or may not be included. In this analysis, I look at oil production of the United States broadly (including crude oil, natural gas plant liquids, and biofuels), because this is the way oil consumption is defined. I also provide some thoughts regarding the direction of future world oil prices.

Figure 1. US Liquid Fuels production by month based on EIA March 2016 Monthly Energy Review Reports.

By December 2015, growth over the prior year finally turned slightly negative, with production for the month down 0.2% relative to one year prior. It should be noted that in the above charts, amounts are on an “energy produced” or “British Thermal Units” (Btu) basis. Using this approach, ethanol and natural gas liquids get less credit than they would using a barrels-per-day approach. This reflects the fact that these products are less energy-dense.

Figure 3 shows the trend in month-by-month production.

Figure 3. US total liquids production since January 2013, based on EIA’s March 2016 Monthly Energy Review.

Taking a longer view of US liquids production, this is what we see for the three categories separately:

Growth in US liquid fuel production slowed in 2015. The increase in liquid fuels production in 2015 amounted to 1.96 quadrillion Btus (“quads”), or about 59% as much as the increase in production in 2014 of 3.34 quads. On a barrels-per-day (bpd) basis, this would equate to roughly a 1.0 million bpd increase in 2015, compared to a 1.68 million bpd increase in 2014.

The data in Figure 4 indicates that with all categories included, 2015 liquids exceeded the 1970 peak by 16%. Considering crude oil alone, 2015 production amounted to 98% of the 1970 peak.

Figure 5 shows an approximate breakdown of crude oil production since 1945 on a bpd basis. The big spike in production is from tight oil, which is another name for oil from shale.

Figure 5. Oil crude oil production

separated into tight oil (from shale), oil from Alaska, and all other,

based on EIA oil production data by state.

Prospects for an Oil Price Rise

Most recent analyses of oil prices have focused on the amount of mismatch between supply and demand, and the need to craft a temporary agreement to reduce oil production. The thing that is missing in this discussion is an analysis of buying power of consumers. Is the problem a temporary problem, or a permanent one?In order for oil product demand to keep rising, the buying power of consumers needs to keep rising. In other words, some combination of consumer wages and debt levels of consumers needs to keep rising. (Rising debt is helpful because, with more debt, it is often possible to buy goods that would not otherwise be affordable.)

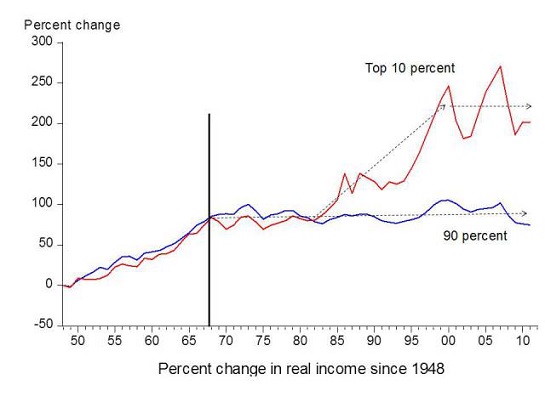

We know that in many countries, wages for lower-level workers have stagnated for a number of reasons, including competition with wages in lower-wage countries, computerization, and the use of automation (Figure 6). Thus, we know that low wages for a large share of consumers may be a problem.

Figure 6. Chart comparing US income gains

by the top 10% to income gains by the bottom 90% by economist Emmanuel

Saez. Based on an analysis IRS data, published in Forbes.

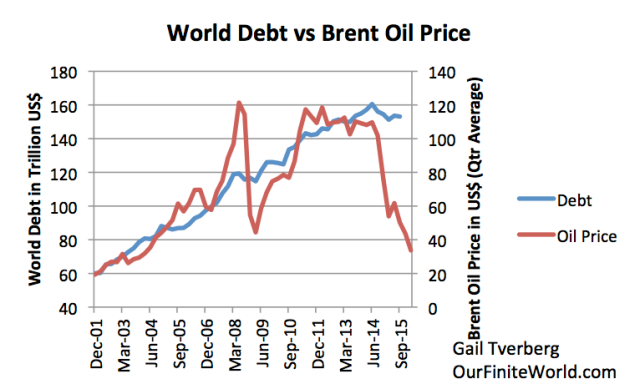

Figure 7. Total non-financial world debt based on Bank for International Settlements data and average Brent oil price for the quarter, based on EIA data.

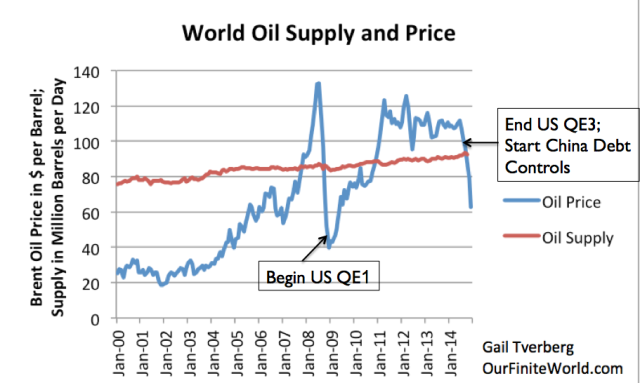

Figure 8. World Oil Supply (production

including biofuels, natural gas liquids) and Brent monthly average spot

prices, based on EIA data.

Another issue that struck me in looking at world debt data is the way the growth in debt is distributed (Figure 9). Debt growth for households has been much lower than for businesses and governments.

Figure 9. World non-financial debt

divided among debt of households, businesses, and governments, based on

Bank for International Settlements data.

The issue that we need to be aware of is that consumers are the foundation of the economy. If their wages are not rising rapidly, and if their buying power (considering both debt and wages) is not rising by very much, they are not going to be buying very many new houses and cars–the big products that require oil consumption. Businesses may think that they can continue to grow without taking the consumer along, but very soon this growth proves to be a myth. Governments cannot grow without rising wages either, because the majority of their tax revenue comes from individuals, rather than corporations.

Today, there is a great deal of faith that oil prices will rise, if someone, somewhere, will reduce oil production. In fact, in order to bring oil demand back up to a level that commands a price over $100 per barrel, we need consumers who can afford to buy a growing quantity of goods made with oil products. To do this, we need to fix three related problems:

- Low wages of many consumers

- World debt that is no longer rising (especially for consumers)

- A high dollar relative to other currencies

0 comments:

Post a Comment